Live Classes

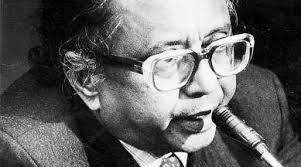

S.Venkitaramanan, an IAS officer who served as the Governor of the Reserve Bank of India (RBI) from December 1990 to December 1992 passed away recently. Two events in which he had participated are worth recording. Both show him as a statesman who did his best for his country, for which he deserves to be remembered.

The beginning

Starting in late 1990, India faced a severe balance of payments stress. This had been precipitated by a slowing of inward remittances and a rise in the price of oil following the invasion of Kuwait by Saddam Hussain. The current account of the balance of payments was subjected to a double whammy, a reduction of receipts and a rise in the value of imports. In 1990-91 the current account deficit swelled to 3 percent of the GDP, a level highest by far in two decades. There was speculation that India would default on its external payment obligations. It was at that moment that the RBI led by Mr. Venkitaramanan played a sterling role, which in effect came to pledging its gold to international banks for a hard currency loan. The details of these initiatives and their significance are set out in the RBI’s official history, “In April 1991, the Government raised $200.0 million from the Union Bank of Switzerland through a sale (with a repurchase option) of 20 tonnes of gold confiscated from smugglers (sic). Again, in July 1991, India shipped 47 tonnes of gold to the Bank of England to raise another $405.0 million. This action helped the country repay its international donors and creditors, though it was not sufficient to completely absolve the country of the crisis.” The act of pledging the country’s gold, which involved transporting it overseas, had been mocked by some in India. It only reveals an ignorance of the world. For the RBI to have used its gold to stave off a default was an act of courage. Indeed, it was the smartest economic management. It only needs to be recalled that India imports around 80 percent of its oil to recognise the practical value of the manoeuvre. Default would have narrowed India’s access to the global loan markets to finance its imports were its export earnings to fall short in the future. With the sale and pledging of India’s gold reserves, a breathing space within the payments crisis had been created.

Download pdf to Read More